Tax claims and fiscal procedures

Many taxpayers balk at the idea of setting in train an action for a fiscal procedure, such as for example the lodging of a tax claim. The length of the proceedings before the Courts of First Instance and then before the Court of Appeal and the costs of lawyers’ fees are major obstacles, even if you are virtually certain that you are in the right.

However, you can most certainly do without a lawyer!

Management of the tax risk

Management of the tax risk

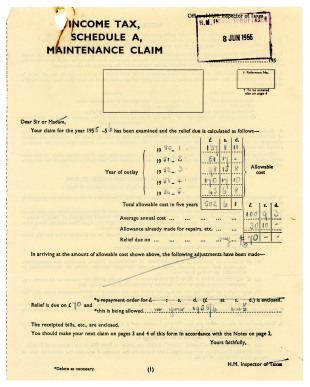

A tax claim – for which your tax consultant has furnished the correct grounds and suitable documentation – very often obliges the regional tax departments to carry out an objective re-assessment of the contested taxation, and thus avoids you having to entertain the court scenario.

And it is not uncommon to see the re-examination of a tax file lead to a very real tax break – coupled with an appreciable financial gain – for the taxpayer: the tax assessment in question almost always relates to several years of income, and the final decision will therefore have a twofold or threefold impact!

The main thing of course is to consult someone who knows what they’re talking about before you go ahead and take these steps. Thanks to the experience of its tax advisers, Tributum tax advisors will guide you through the maze of recent jurisprudence and administrative circulars which, when all is said and done (it is worth recalling), are not laws at all, but merely administrative instructions intended for civil servants working in the tax office!

If you have definitely made up your mind, don’t wait too long: a tax claim will only be accepted within six months of the notice of tax assessment (the tax calculation) in question.

There is also a less well-known alternative: the so-called automatic tax relief procedure, which is possible for example in the event of a material error or new conclusive evidence, and which gives you five years in which to react and indicate your disagreement!

Contact form or call us: mobile phone no.: 0473 473 000

An initial opinion does not cost you anything and could safeguard your taxpayer’s rights, your personal finances or your company’s cash position!